Vendreo Payment

Processing Solutions.

Empowering businesses with fast, safe, and secure online transactions.

Cardless Payments

Secure Payments

Fast Payments

Get accepted today.

Get accepted with your perfect

Payment Processing Solution.

We accept more than any other Payment Processor provider.

Having trouble getting accepted with the right Payment Processor for your business needs?

Take the stress out of getting accepted with Vendreo. We offer solutions to businesses of all industries and risk levels.

Our experts will assess your needs and match you with your ideal Vendreo Payment Processor plan.

Need to know more?

We'll do the hard work for you.

Complete the quick form below to have your needs assessed and get accpeted.

A Vendreo Expert will assess your details and contact you with your best options for getting accepted quickly.

What happens once I complete the Form?

By completing the above form, you are requesting further information regarding your ideal Payment Processing Solution.

We will assess your needs and circumstances and contact you with a tailored proposition, utilising one of our Payment Processing offerings.

The Solutions

We Offer.

Payment Solutions to suit all Merchants.

Vendreo offer two staple Payment Processing Solutions.

Each Solution has a unique service offering, benefitting an array of business types and models depending upon circumstances.

We match you and your business to the best-suited Payment Processing Solution.

Vendreo OpenPay is a complimentary Open Banking service addition to both Vendreo Solutions.

- More About Our Solutions

Instant Acceptance.

Vendreo Pay.

Say goodbye to tedious waiting periods and hello to instant vetting and immediate acceptance with Vendreo Pay. We are revolutionising the way you handle online payments, making it easier than ever to grow your business.

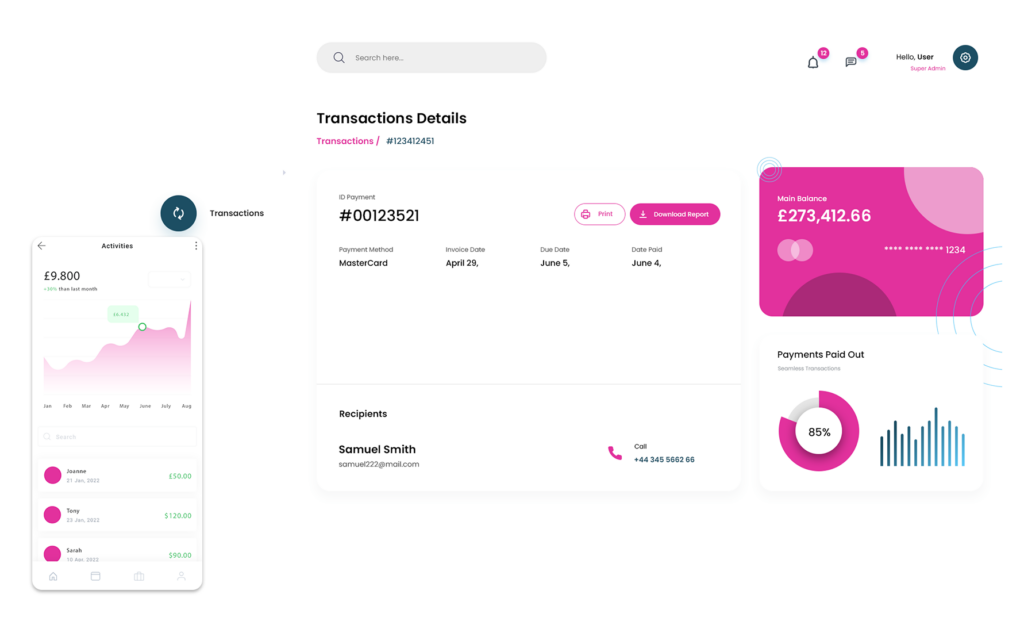

Payment Processing made simple.

- Instant Sign-up Process

- Easy Integration

- Instant Card Processing

- Just 1.2% Transaction Fee (+ 15p)

Cheaper than Stripe & PayPal.

Compared to alternative payment solutions like Stripe or PayPal, Vendreo Pay offers competitively low fees that help you maximise your profits.

Why pay more when you can save with Vendreo Pay? Experience the perfect combination of affordability and efficiency by making the switch today.

Direct Merchant Accounts.

Vendreo DirectPay.

DirectPay builds on the secure framework of Vendreo Pay and adds a Direct Merchant Account to give you greater flexibility and even lower costs.

Our inclusive approach ensures that every business, regardless of its niche, can benefit from our versatile payment solutions. With Vendreo, there are no limitations. Experience seamless and secure payments tailored to your industry-specific needs.

Join us today and unlock the additional complimentary benefit of Open Banking.

A 'Grown-Up'

Payment Solution.

We understand that every sector deserves a chance to succeed, which is why we provide tailored payment services that cater to all industries.

Our mission is to break down barriers and ensure that all businesses, regardless of their risk level, can accept payments with confidence.

Experience the difference of a payment partner who sees potential where others see risk. Join Vendreo today and unlock the power of inclusive and impactful payment solutions.

Ultimate fraud prevention with Biometric security verification checks, enabling ease of use and security for your customers.

Zero Fraud = Zero Chargebacks. Keep both your customer and your business safe with Vendreo Pay.

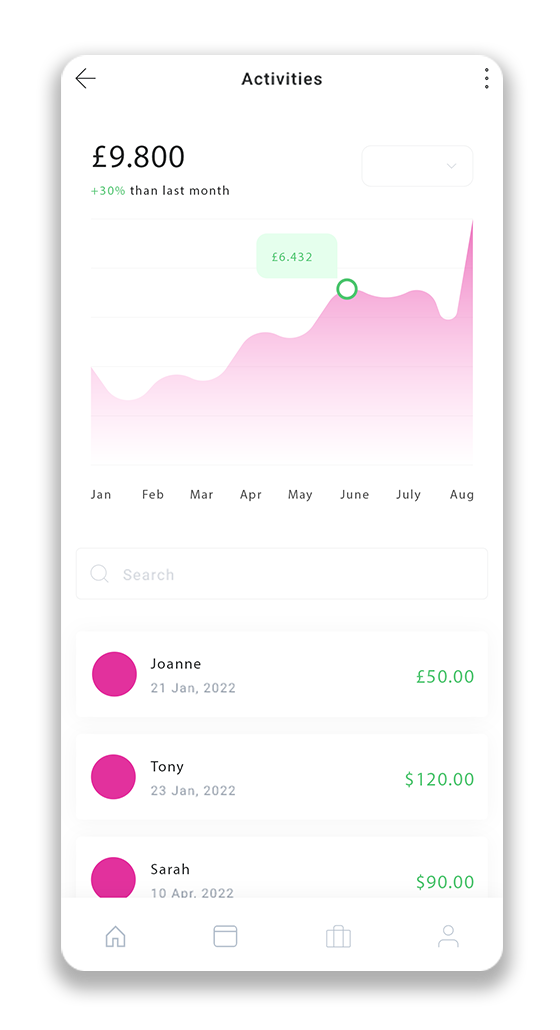

Robust and streamlined checkout processes that significantly reduce abandoned carts. Enhance the user experience and increase revenue.

By making it easier for customers to pay via a secure and trusted payment method, transaction completions significantly increase, reducing abandoned carts and unfulfilled orders.

Fraud-free Finances.

Vendreo OpenPay.

A Complimentary Service Offering

Boost your business with Vendreo OpenPay Open Banking solutions! Trustworthy and direct data sharing ensures secure transactions, eliminating fraud and slashing chargebacks.

With our seamless integration, say goodbye to online cart abandonment and inspire customer confidence. Our reliable solutions guarantee increased revenue and will elevate your business to the next level.

Don’t miss out on the chance to provide top-notch security and boost your revenue. Choose Vendreo for unparalleled Open Banking solutions.

With us, you can be confident that your payments are secure and your business is thriving.

More options = more transactions.

Receive funds from all major credit and debit cards, e-wallets and open banking apps in an instant.

Safe and secure payments through SMS and Mobile Open Banking Apps.

Secure regular subscription payments with the guaranteed safety of your customers sensitive information.

Annual, quarterly, monthly and weekly recurring payments backed by safe and secure payment processing.

Convenient one-click payment processing for ease of use, encouraging customer retention.

Cover all payment options and offer more ways to pay.

Navigating the digital world of transactions doesn’t have to be complicated. We bring to you an all-in-one payment solution, engineered for every business, big or small.

Global & Multi-Currency Payments Made Simple.

Accept payments from all over the world, in a variety of currencies, with Vendreo's Global Payment Solutions.

Any Currency. Anywhere.

Never miss a sale with Vendreo Global Pay.

- Fast

- Safe

- Secure